[ad_1]

As a part of its $214.5 billion 2024 funds unveiled at the moment, the Authorities of Ontario rolled out a number of housing initiatives geared toward rising provide and facilitating the event of purpose-built leases.

The investments embody a three-year $1.2 billion “Construct Quicker Fund” to assist expedite the development of recent housing together with elevated funding for core housing infrastructure.

The general investments made all through the funds come on the expense of a balanced funds, with the province now projecting a deficit of $9.8 billion within the coming fiscal yr—practically double its preliminary estimate in its Fall Financial Replace.

Ontario funds housing highlights

The next are highlights of the federal government’s key housing-related bulletins contained in its 2024 funds.

Housing provide and infrastructure

The federal government introduced it is going to dedicate $1.2 billion over three years to incentivize municipalities that meet or exceed housing building targets.

This fund goals to streamline the housing improvement course of, encouraging sooner building to assist alleviate the housing provide scarcity in Ontario.

- Municipal Housing Infrastructure Program

The federal government is allocating $1 billion in the direction of core infrastructure initiatives via an funding within the Municipal Housing Infrastructure Program. By specializing in core infrastructure, this system is predicted to help the foundational wants for residential building, enabling extra houses to be constructed.

- Elevated funding for the Housing-Enabling Water Programs Fund

With a rise to $825 million, this fund targets municipal water infrastructure initiatives, an important part of recent housing developments.

Extra housing initiatives

The province is increasing the authority for all single- and upper-tier municipalities to impose taxes on vacant houses, aiming to extend housing provide and enhance affordability.

The federal government mentioned this extension, beforehand accessible to cities like Toronto, Ottawa, and Hamilton, will enable extra municipalities to discourage residence vacancies. A brand new provincial coverage framework will information the implementation of Vacant Residence Taxes and encourage municipalities to set a better fee for foreign-owned vacant properties.

- Non-Resident Hypothesis Tax

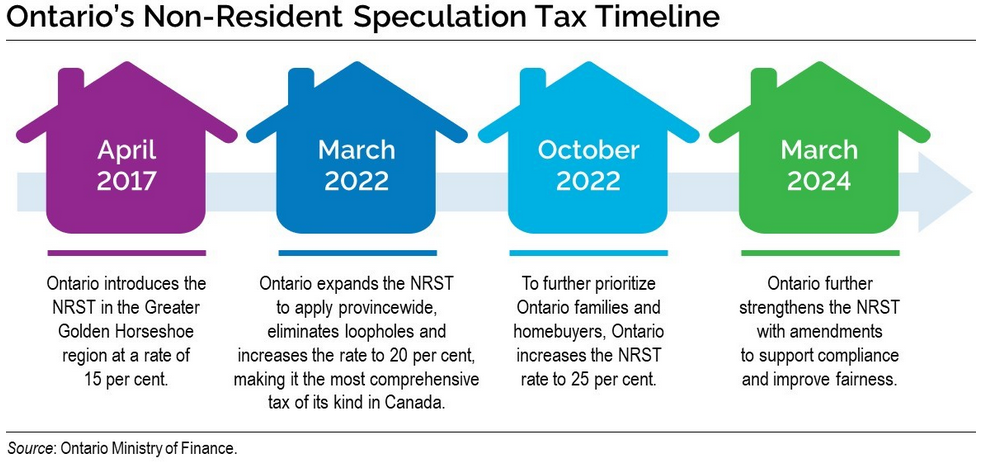

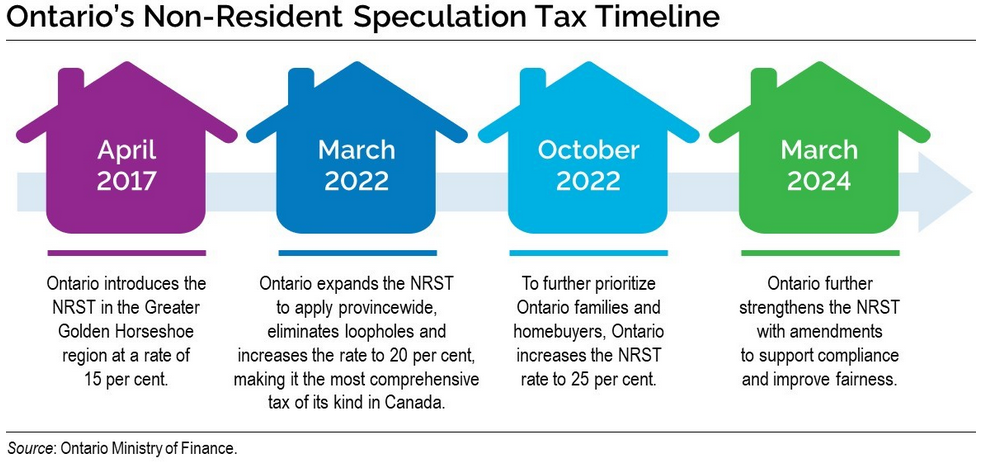

Ontario has up to date its Non-Resident Hypothesis Tax (NRST) to additional handle the impression of international funding on the housing market with a said purpose of guaranteeing extra houses can be found for Ontario residents.

Initially, the tax was expanded throughout the province and elevated from 15% to 25% in 2022. The federal government is now specializing in extra amendments to reinforce the NRST’s effectiveness, guaranteeing compliance and selling equity within the housing market. The federal government says these steps will assist deter speculative shopping for by international entities and “enhance equity” for the folks of Ontario.

- Reducing taxes on purpose-built rental properties

The federal government pointed to 2 initiatives geared toward supporting the development of purpose-built rental housing within the province:

- The elimination of HST for brand new purpose-built leases: As was beforehand introduced within the fall, the province has up to date the HST New Residential Rental Property Rebate to remove the 8% provincial portion of the tax on new purpose-built rental properties, together with residences, pupil, and senior housing, beginning initiatives between September 14, 2023, and December 31, 2030. This aligns with federal efforts to take away its portion of the tax on such initiatives, ensuing within the complete elimination of the 13% HST on qualifying builds.

- Municipal tax flexibility for leases: Ontario now permits municipalities the pliability to use decreased property tax charges on new multi-residential rental properties. This quick coverage change provides native governments the instruments to encourage the event of rental housing, addressing affordability and availability.

- Investing in modular building

The province is implementing an “attainable housing program” to facilitate residence possession for extra households, with an emphasis on modular building and different progressive constructing strategies to quicken improvement and enhance affordability.

This method not solely goals to develop the supply of reasonably priced housing, but additionally helps the expansion of native industries and job creation, the federal government says.

Response to the federal government’s housing initiatives

Whereas the deal with addressing the province’s housing provide scarcity and affordability challenges was welcomed by a number of business associations, questions stay over whether or not it is going to be sufficient.

A member discover despatched by Mortgage Professionals Canada drew consideration to the actual fact there have been roughly 89,000 housing begins in Ontario in 2023, properly in need of the province’s goal of 125,000 for this yr. The province can also be concentrating on 175,000 annual begins by 2026 to satisfy its purpose of constructing 1.5 million new houses by 2031.

“Because of this we’ll proceed to advocate for insurance policies at each the federal and provincial degree geared toward rising provide, decreasing prices, and finally serving to extra Ontarians obtain the dream of residence possession,” MPC’s member notice reads.

The affiliation continues to advocate for initiatives similar to permitting the Property Switch Tax to be paid in instalments, rising the land switch tax for first-time patrons from $4,000 to $8,000, revising the provincial HST New Housing Rebate to align with present residence costs, and streamlining the event approval course of.

Ontario Actual Property Affiliation (OREA) President and CEO Tim Hudak applauded the investments in constructing extra houses, however mentioned the federal government “should hold their foot on the gasoline and take daring motion,” in an effort to obtain its goal of constructing 1.5 million houses.

“Constructing extra houses on current properties is a necessary key to unlocking reasonably priced homeownership,” he mentioned in a launch. “A number of municipalities, together with Toronto, London, and Barrie, have led the way in which by proactively enabling 4 models as-of-right per lot, and it stays a key suggestion of the Province’s personal Housing Affordability Job Drive.”

[ad_2]