[ad_1]

On March thirteenth, Cummins provides you with $107.53 of worth for each $100 of Cummins inventory. It’s a 7.53% return in lower than a month.

It’s referred to as an odd lot tender supply and one of many solely methods a smaller investor has a bonus of institutional buyers.

However what’s an odd lot tender supply?

A tender supply is a bid to buy a shareholder’s inventory and an odd lot is when you will have 1 – 99 shares. A spherical lot is when your variety of shares is evenly divisible by 100 – so 100, 200, 300, and many others.

Thus, an odd lot tender supply is when an organization affords to purchase again its personal shares with a separate provision for these with “odd tons,” or lower than 100 shares. These might be referred to as odd lot buybacks.

Typically, an organization doesn’t make a agency supply however as an alternative conducts a Dutch public sale to determine a worth. A Dutch public sale is when the value begins excessive and is lowered till the variety of bids meets the variety of shares the corporate desires to purchase again.

Lastly, an organization solely desires to amass a sure variety of shares. If the supply is oversubscribed, which is when the variety of shares exceeds what the corporate desires, they may pro-rate what number of shares every shareholder can promote. They typically make exceptions to odd tons as a result of they’re so small and that is the place you are available.

I’ve been studying about odd lot tenders for fairly a while, often as a result of Jonathan at My Cash Weblog writes about them (the newest includes Cummins and Atmus Filtration), however I’ve by no means participated.

Immediately, I simply may.

Desk of Contents

What’s the Cummins & Atmus Filtration Deal?

Cummins (NYSE: CMI) spun off Atmus Filtration (NYSE: ATMU) however nonetheless owns 80% of ATMU’s inventory.

They’d prefer to personal much less, in order that they’re providing $107.53 of ATMU for each $100 of CMI inventory. There’s no Dutch public sale on this one, simply a suggestion.

The higher restrict is 13.3965 shares of Atmus Widespread Inventory per share of Cummins Widespread Inventory and there’s no decrease restrict (no minimal trade ratio).

Earlier than the market opened on February twenty sixth, Atmus shares had been valued at $22.81 and CMI inventory was valued at $263.97. That’s a ratio of 11.57 so we’re nonetheless below the higher restrict.

- What’s the tender supply? Get $107.53 of ATMU for each $100 of CMI

- What’s the higher restrict ratio? 13.3965 shares of ATMU to CMI

- What’s the decrease restrict ratio? No decrease restrict.

- When is the expiration date of the supply? March 13, 2024.

What Are The Advantages?

The advantages are that you just personal an odd lot, you settle for the tender, and also you obtain $107.53 of ATMU inventory for each $100 of CMI inventory. That’s a 7.53% return in lower than a month.

In case you purchase 99 shares of CMI at $263.97, that’s a complete worth of $26,133.03. You’d get ~$28,100.84 of ATMU, for a achieve of $1,967.81.

When you get the ATMU inventory, they’re yours to do as you want. You possibly can promote the shares or maintain onto them.

Since odd tons max out at 99 shares, that is often engaging to smaller buyers or monetary advisors who wish to reap the benefits of this arbitrage alternative to offset charges.

What Are The Dangers?

Odd lot tenders will not be assured income.

There are fairly a number of dangers.

The most important threat, although extraordinarily uncommon, is that the deal is withdrawn or terminated. This not often occurs however is feasible. There are a number of circumstances by which the supply might fail to undergo. The almost definitely (and that is extraordinarily unlikely) one is that if there will not be sufficient shares being bought again (not sufficient ATMU inventory being bought to CMI). One other one is that if they obtain “an opinion of counsel that the trade supply will qualify for tax-free remedy to Cummins and its collaborating stockholders.” (from their press launch)

If this occurs, the inventory will possible go down. Among the shareholders had been solely proudly owning it for the odd lot tender supply, so these buyers will promote their shares.

The deal could possibly be prolonged. The present deadline in March could also be prolonged for no matter cause and this would scale back the full return from the deal for the reason that holding interval is elevated.

The following main threat is that the respective inventory costs transfer in such a method that you just now exceed the higher restrict ratio. In case you exceed the higher restrict ratio, the quantity of ATMU inventory you get on your CMI inventory will go down. Your 7.53% premium will get smaller.

The inventory may go down in worth whilst you await the tender. CMI inventory continues to commerce and its worth will change. If it goes up, improbable! If it goes down, that eats into your returns.

Lastly, the final threat is that the inventory costs go down after the sale (and it almost definitely will go down). All these ATMU shares that had been in CMI coffers at the moment are in shareholder arms. A few of these shareholders had been solely in it for the arbitrage alternative in order that they’re promoting the second they get the shares.

The one query is whether or not this strain shall be higher than the premium and the way rapidly will you be capable to promote the shares.

One threat you gained’t face is being prorated. What’s good about odd lot tenders is that you just don’t have to fret in regards to the threat of pro-ration – since odd tons will not be topic to pro-ration.

How Do You Settle for The Tender Supply?

As a matter of protocol, should you personal an odd lot and don’t settle for the tender, you’ve successfully declined it. It’s a voluntary company motion. In case you miss the discover and don’t reply, you’ve successfully declined it. (company actions which might be necessary are mergers, inventory splits, spin offs, and many others.)

The deadline for the CMI/ATMU supply is March thirteenth however some brokerages may have you to reply forward of that date.

Let’s say you personal an odd lot of an organization that has made an odd lot tender, how do you go about accepting it? This can fluctuate from brokerage to brokerage. Some can have a option to do it on-line, others would require you to name in.

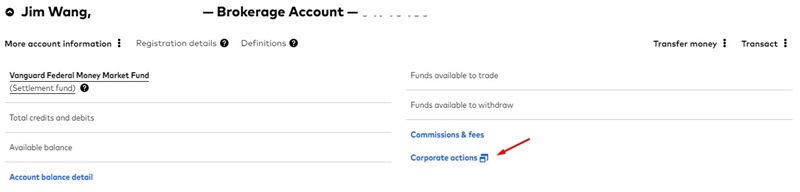

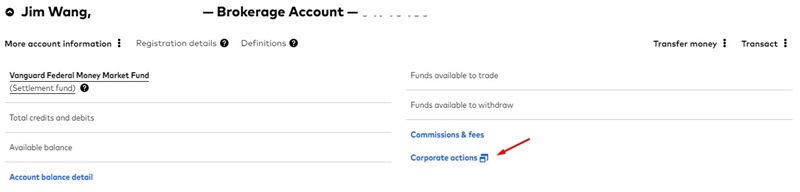

In Vanguard, there’s Company actions menu in your brokerage account view:

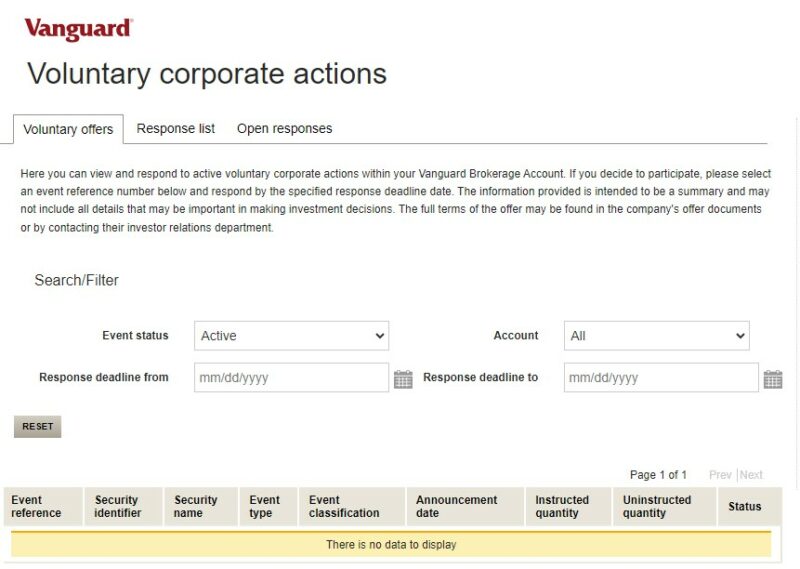

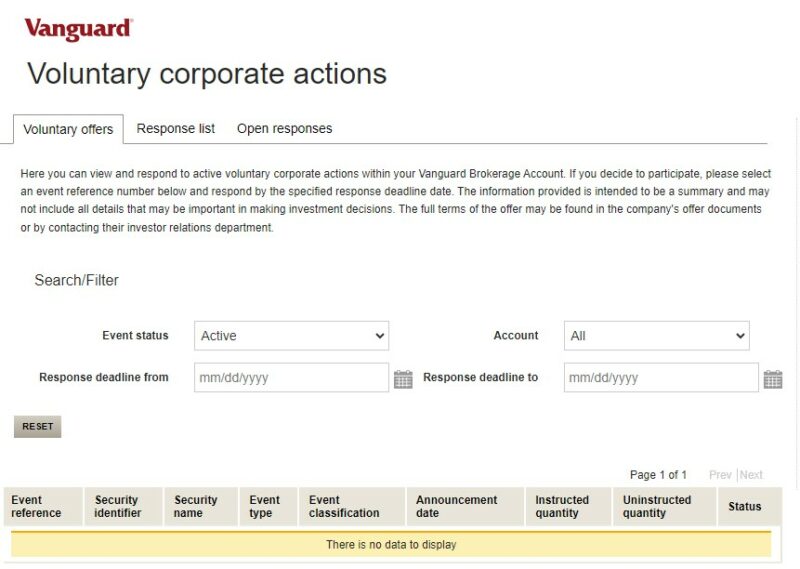

This opens a window the place you may reply to Voluntary company actions:

As of this writing I don’t personal any shares of CMI so there are not any company actions to indicate.

When you settle for the supply, you’ll possible get the shares of ATMU about 7 enterprise days after the deadline.

Why Do Corporations Do This?

There are numerous causes. For some, they wish to scale back the variety of shareholders.

Typically an organization owns a big portion of one other firm, both by spinoff or another motion, and so they wish to reap the benefits of it to enhance their share worth. In 2023, Johns & Johnson (NYSE: JNJ) spun off its client staples unit, Kenvue (NYSE: KVUE), and held 90% of the corporate. J&J supplied to purchase again its inventory utilizing shares of Kenvue, moderately than money and did so at a 7.5% premium. For each $100 of JNJ it bought, it will give the shareholder $107.53 in KVUE inventory.

Regardless of the cause, the beneficiary is you, the smaller investor, as a result of you may (doubtlessly) earn a fast premium.

[ad_2]