[ad_1]

Seventeenth-century French mathematician and thinker Blaise Pascal put ahead this reasoning on whether or not one ought to imagine in God (paraphrasing):

You’re unsure whether or not God exists. For those who imagine in God and God doesn’t exist, you reside with some pointless inconvenience. For those who don’t imagine in God and God does exist, you obtain infinite struggling. The price of being unsuitable is far greater within the latter case. Due to this fact it is best to imagine in God whether or not God exists or not.

That is known as Pascal’s wager. It’s a technique to attenuate loss if you’re unsure.

We face many legal guidelines and guidelines in dealing with our funds. Once we’re unsure how the legal guidelines and guidelines work, we will:

A) Spend hours and hours researching the topic and attempting to grasp the terminologies and the way they match collectively. We should still come to the unsuitable conclusion regardless of our greatest efforts.

B) Discover and rent an skilled and depend on the skilled’s opinion. We could not discover the true skilled and the skilled can nonetheless be unsuitable.

C) Use Pascal’s wager and weigh the price of being unsuitable. Select the trail of the least expensive consequence if we’re unsuitable.

Typically it isn’t value spending the time or cash to search out out the true reply to some difficult questions. Utilizing Pascal’s wager is the best option to reduce the harm in case you’re unsuitable. Let’s take a look at some real-life examples I got here throughout these days.

Required to File a Tax Return?

Not everyone seems to be required to file a tax return. The IRS has an Interactive Tax Assistant with a sequence of questions to find out whether or not somebody is required to file a tax return. You should use it for your self, your father or mother, or your little one. The questions in that assistant software aren’t all simple although. What for those who’re unsure the way to reply a few of the questions?

For those who’re required to file a tax return however you assume you aren’t, you’ll face penalties for failing to file as required. For those who’re not required to file a tax return however you file one anyway, such a easy return is straightforward to do and it prices nothing. Pascal’s wager says it is best to file a tax return anyway.

Submitting a tax return whether or not required or not has different advantages too. Some individuals had a more durable time receiving stimulus funds from the federal government in the course of the pandemic as a result of they didn’t file a tax return in a earlier 12 months when it wasn’t required. It will’ve been a lot simpler if they’d filed a tax return anyway.

The identical reasoning additionally applies to submitting a present tax return and submitting a Type 5500-EZ for a solo 401k. Submitting a kind if you is probably not strictly required to take action takes just a little little bit of time however there’s no tax to pay. Mistakenly pondering you’re not required to file when it’s truly required incurs massive penalties. Within the case of Type 5500-EZ, the penalty is $250 per day!

When doubtful, file a tax return.

Take the RMD? Based mostly on Whose Age?

The foundations on Required Minimal Distributions (RMD) for an inherited IRA are fairly complicated. It depends upon when the unique proprietor died, at what age, whether or not the IRA had a delegated beneficiary, whether or not the designated beneficiary was an individual or a belief, the connection between the unique proprietor and the beneficiary, the age distinction between the unique proprietor and the beneficiary, and so forth.

For those who’re required to take the RMD from the inherited IRA, the following query relies on whose age. Is it based mostly on the unique proprietor’s age or the beneficiary’s age?

The foundations are so complicated that Vanguard stopped calculating the RMD for a lot of inherited IRAs for concern of doing it unsuitable. They punted that accountability again to the shoppers and requested them to seek the advice of a tax skilled.

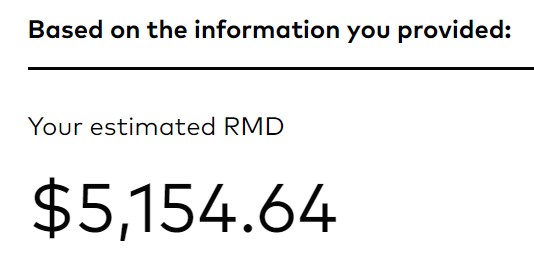

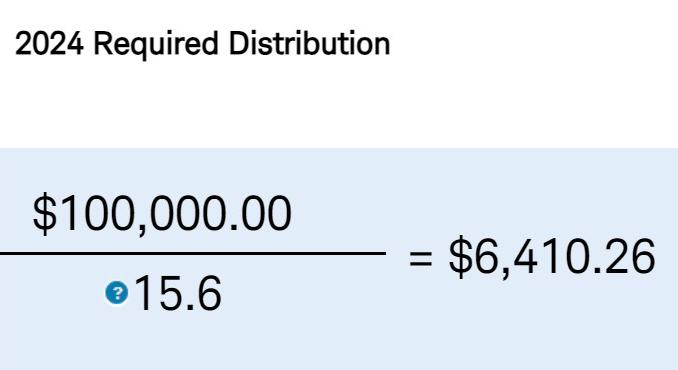

Vanguard nonetheless has an on-line RMD calculator for inherited IRAs. Charles Schwab has one too. The 2 calculators displayed totally different outcomes when a reader gave them an identical inputs. I attempted each of them with this hypothetical case:

- IRA Stability on December 31: $100,000

- Proprietor’s Date of Start: Might 15, 1955

- Proprietor’s Date of Dying: Might 15, 2023

- (Non-Partner) Beneficiary’s Date of Start: Might 15, 1950

The primary end result was from Vanguard’s calculator. The second end result was from Schwab’s calculator. The outcomes diversified by virtually 25%! Which one is right? After all each calculators have disclaimers to say they shouldn’t be relied on as authorized or tax recommendation.

You possibly can examine the complicated guidelines many times and get a level in RMDs. Or you possibly can pay a CPA and ensure the CPA actually understands this topic and also you’re not miscommunicating with the CPA. Or you possibly can see which path provides you the least unhealthy consequence if you’re unsuitable.

For those who take the RMD if you aren’t required to take it, the cash comes out of the IRA just a little sooner. The cash finally has to return out of the IRA anyway. Timing solely makes a small distinction. For those who don’t take the RMD when you’re truly required to take it, you face a a lot greater penalty.

Equally, when two calculators give two totally different RMD quantities and also you’re unsure which one is the true minimal, it’s completely OK to withdraw a better quantity as a result of the RMD is barely a minimal. You’ll be in additional bother for those who withdraw lower than required.

When doubtful, take the RMD. When doubtful, withdraw a better quantity.

The Final Day to Purchase I Bonds

I Bonds credit score curiosity month-to-month. It doesn’t matter which precise day within the month you purchase I Bonds. You get curiosity for the complete month so long as you maintain I Bonds on the final day of that month. Due to this fact it’s higher to purchase I Bonds near the tip of a month.

How shut although? When is the final day to purchase I Bonds and nonetheless get the curiosity for that month? Is it the final enterprise day of the month? Or is it the second final enterprise day of the month? Or the third final enterprise day of the month?

For those who assume it’s the final enterprise day of the month however the deadline is definitely the second final enterprise day of the month or for those who assume the deadline is the second final enterprise day of the month however it’s truly the third final enterprise day of the month, your buy will miss a full month’s value of curiosity. For those who assume the deadline is sooner however it’s truly later, you’re shopping for just a little too quickly and also you forego incomes curiosity in your financial savings account or cash market fund for a day or two, which is lots higher than lacking a full month’s value of curiosity.

I give it per week once I purchase I Bonds. The identical goes for paying taxes. I set the date of my cost to per week earlier than the due date. If something goes unsuitable I nonetheless have time to repair it and take a look at once more.

When doubtful, do it sooner.

Solo 401k Contribution Restrict

I’ve a Solo 401k contribution restrict calculator for part-time self-employment. A reader requested me about it as a result of his Third-Get together Administrator (TPA) gave him a decrease contribution restrict. Though I’m assured that my calculator is right, I stated he ought to go along with the decrease quantity from the TPA.

The calculated contribution restrict is barely a most. Nobody says you could contribute the utmost. It’s completely OK to contribute lower than the utmost. If the TPA is aware of one thing that I don’t, it’ll be a large number if the reader goes with the upper quantity from my calculator and exceeds the authorized most.

When doubtful, contribute much less.

***

It’s not value spending the time or cash to search out the true solutions to some difficult questions. You should still be unsuitable after spending the time or cash. As an alternative, consider the results if you’re unsuitable. If the results are lopsided between two decisions, as they typically are, use Pascal’s wager and select the trail that prices much less if you’re unsuitable.

Say No To Administration Charges

If you’re paying an advisor a proportion of your property, you’re paying 5-10x an excessive amount of. Learn to discover an unbiased advisor, pay for recommendation, and solely the recommendation.

[ad_2]